Digitization of Mortgage

mort-gage

(old french)

noun1.

Death Pledge

CMHC released a publication on Mortgage Data Standards–analyzing the impact of initiating a system of data standards in the Canadian mortgage industry. One aspect of the data standards framework I'm paying close attention to is what the acceleration of digitization means to the future of mortages. The overarching premise is to provide the foundation for innovation development, and facilitate easier technology adoption.

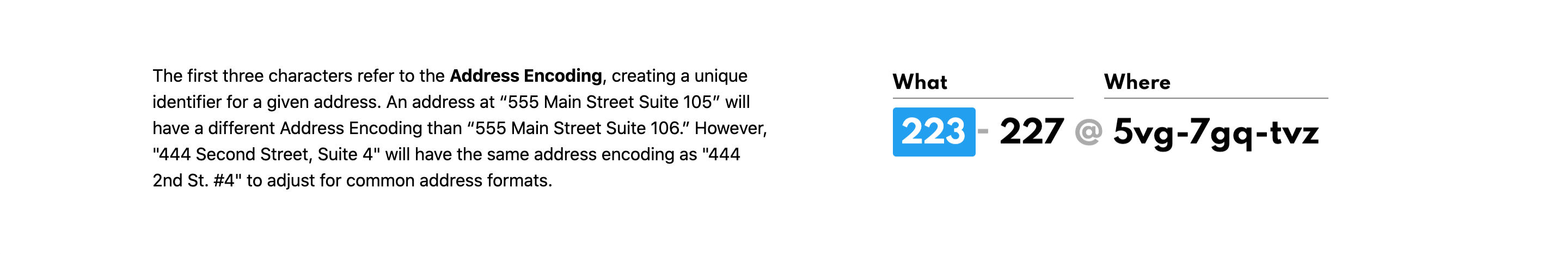

The recent launch of Placekey–an intiative surrounding a universal place identifier that unifies location data–already demonstrates the collective shift toward an open ecosystem of data elements, definitions, and relationships that make up a reference model. It's a movement of organizations and individuals that prize access to geospatial data.

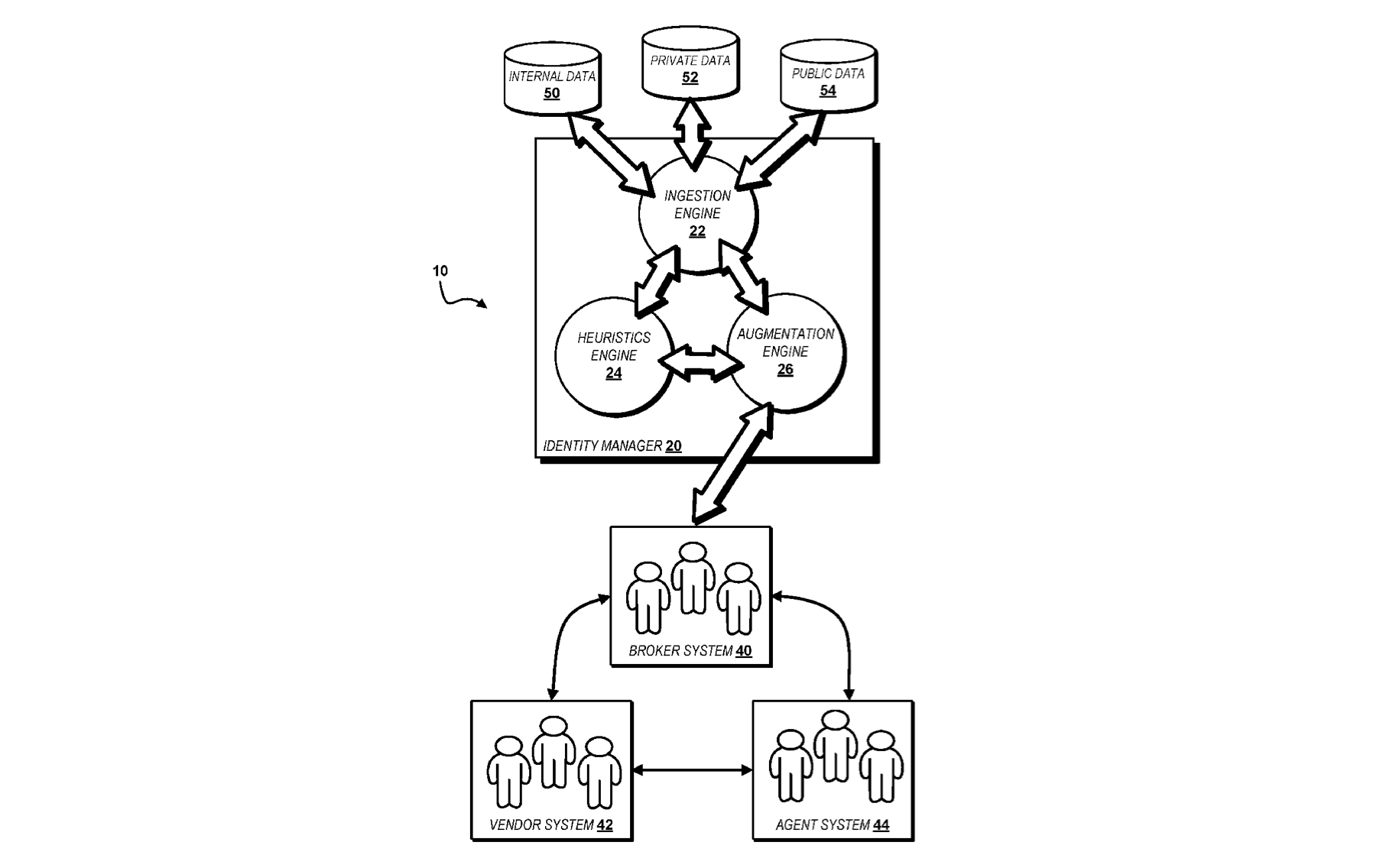

Cherre is another interesting startup to watch in this space, part of an already impressive list of Placekey's launch partners. They deploy a similar form of data unification, in their case with a patented Entity Resolution Computing System that connects disparate entities, of which in real estate there are many.

"Many industries rely on publicly sourced network-accessible data, the quality and accuracy of which is not always easily ascertained. Resolving entities based on such data can be computationally intensive based on the volume and quality of the data. The real estate industry in particular is faced with data from various disparate municipalities which is maintained at different levels of government, including for example borough, city, county, and state governments." – Cherre, Inc.

As data grows exponentially, so too does the value of connecting and identifying inferences between entities. According to the CMHC publication, they detail four promising technologies that require consistent data to function:

- Microservices – accelerates time to market, increases customer satisfaction.

- Blockchain – competitive loan offers and secure transactions.

- Application Programming Interfaces (APIs) – consistent data access to engage potential borrowers.

- Artificial Intelligence – identifies fraud, and detects anti-money laundering patterns.

Covid-19 has accelerated the rapidly increasing consumer demand toward online services, yet CMHC acknowledges that Canada still remains far behind the U.S. in part because of the lack of data standards. Here are some highlights describing the benefits of data standards in the mortgage industry:

Increased Operational Effeciencies

- Reduced number of custom IT interfaces, which will extend to interactions with LOS providers, credit report providers, appraisers, brokers, title insurers and lenders.

- Allowing technology providers to build single integrations that can then be reused with any firm who builds to the same standard. This eliminates the need to create similar products for multiple firms.

Facilitate Mortgage Funding

- Mortgage standards minimize information asymmetry issues by providing investors with better confidence through precision and clarity in the data they use to make decisions.

- Reduce risk of systemic mispricing of risk and potential pricing overcorrection, particularly to asset/mortgage-backed securities.

Enhanced Analytics and Data Sharing

- Make better decisions by accessing additional and better data.

- The establishment of a common language will enable CMHC to provide more data, in both scope and granularity.

The threat exists to traditional lenders that have not embraced digitization, as new fintechs move into this space with services that have come to be expected by consumers. Interoperability between the increasing number of systems in the mortgage industry lead to improved customer experiences, reduced costs, and fully leveraging the API economy.

"Reductions in information asymmetry in the securitization market attract more investors and lower funding costs for lenders." – CMHC