Investor Boom

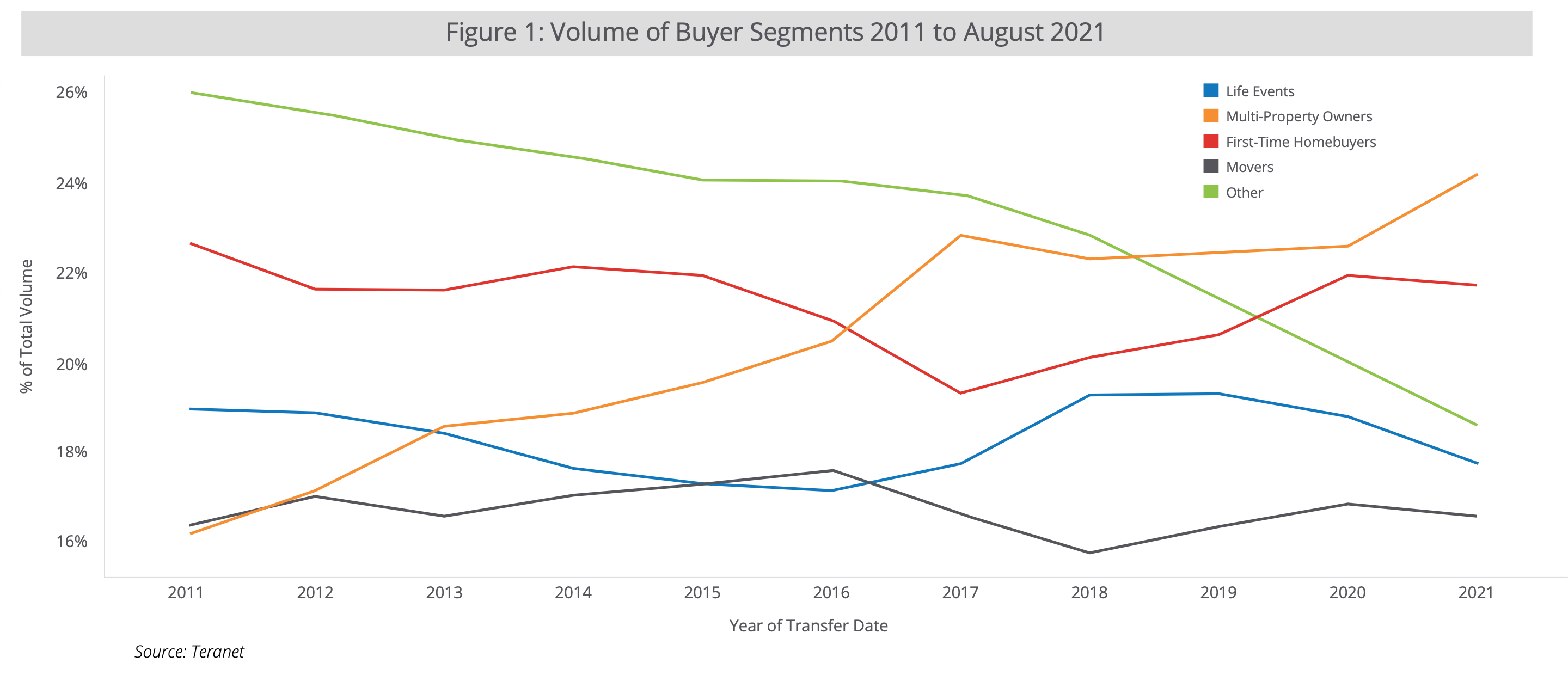

A revealing report by Teranet suggests that investors now make up 25% of Ontario homebuyers. The number of mortgages taken out by investors doubled in the last year, as per the Central Bank. The "extrapolative" demand is being attributed to the expectation that prices will keep rising, a.k.a. Fear of Missing Out (FOMO).

"When investors are the biggest segment of the buyer base, no amount of supply is enough", says John Pasalis of Realosophy. An optimal level of investor demand is where they are contributing to much needed rental supply, but aren't having an outsized impact on house prices, thereby amplifying boom and bust cycles.

Investors (those who already own houses and purchase non-principal residences) eclipsed newbie buyers (22%) for the first time. This segment is comprised of small-time investors, speculators, flippers, and amateur landlords. Consequently, this led to intense competition, price escalation, and family investors draining equity in existing homes to buy more of them. The financialization of real estate.

I sit between a rock and a hard place, being a real estate investor as well as a real estate agent. I am all for leveraging your hard-earned assets to buy investment properties with high return and low risk. Generational wealth to provide financial security for your family. Though I empathize with first-time homebuyers such as those mentioned in recent news articles, when they are "chasing their dream" only to be priced out again and again.

"It's either going to result in a generational shift of people leaving the province or it's going to result in eventually some kind of price deterioration that's going to catch a lot of people off side." – Ron Butler