Rental Housing

"Don't find fault, find a remedy." – Henry Ford

It's amazing how quickly society's attention can be so easily diverted from one current event to the next. From a pandemic, to convoys, to wars, to celebrity outbursts, to billionaire hostile takeovers, and eventually the media portrayal of "home sales crashing on higher interest rates". The real estate market is undoubtedly headed toward a correction, due to strong base effects from record-high sales in 2021.

It is evident that rising interest rates have already led to a slowdown in housing activity. How far the BoC is willing to go with these rate hikes remains to be seen. Regardless, closings happen every single day. Instead of trying to time the market, which is ill-advised, it is better to understand where things are trending in relation to your real estate goals and act accordingly. Better to be an opportunist.

I believe the fear-mongering is weeding out many a buyer in over their heads, overleveraged from cheap credit and FOMO (Fear of Missing Out). Word on the street is that some buyers are consulting with their lawyers, looking for ways to back out of their contract because they didn't expect rates to increase so rapidly and property values to head in the opposite direction. Unfortunately, some will end up losing more than their deposit.

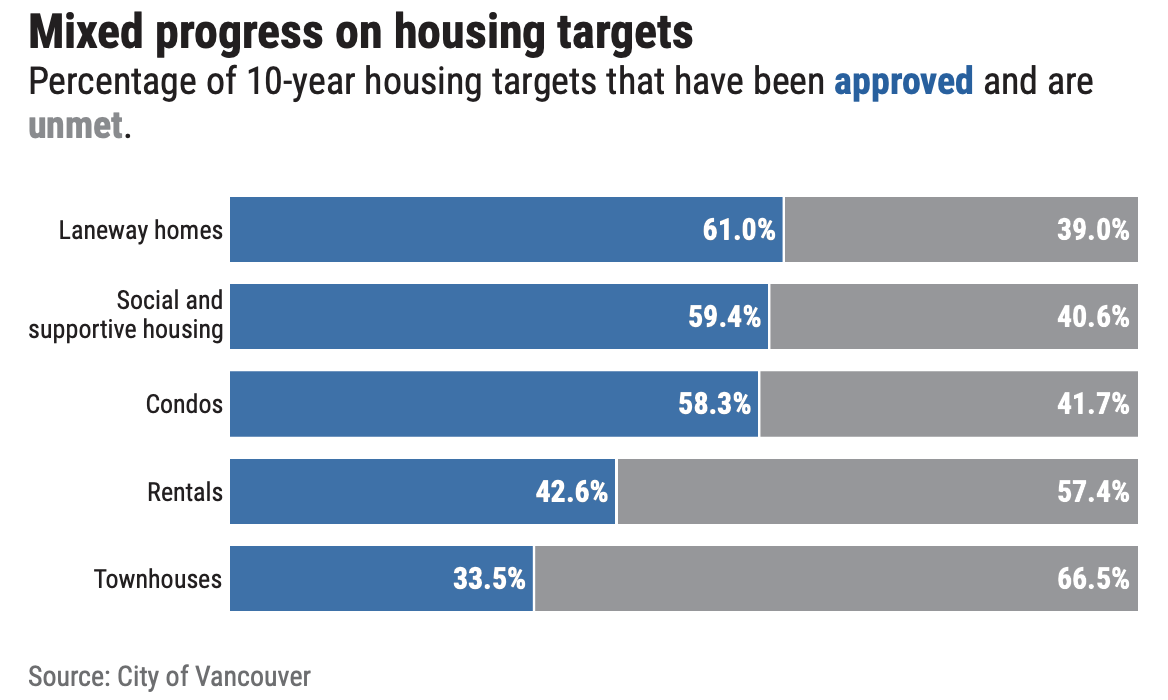

There is a clear and continuing shift away from building homes for ownership, to purpose-built rental housing. The aging inventory of houses along main arterial roads is being sold off in great numbers, with the land being assembled for multi-family housing. I've personally spoken with sellers concerned it is only a matter of time before it happens to them. Just look along Broadway, East 1st Avenue, Cambie, Main, and Fraser Street for evidence. It indicates that condos are currently a good bet when considering an investment property. The Vancouver Plan does not factor in single-family and duplex zoning—paving the way for increased density.

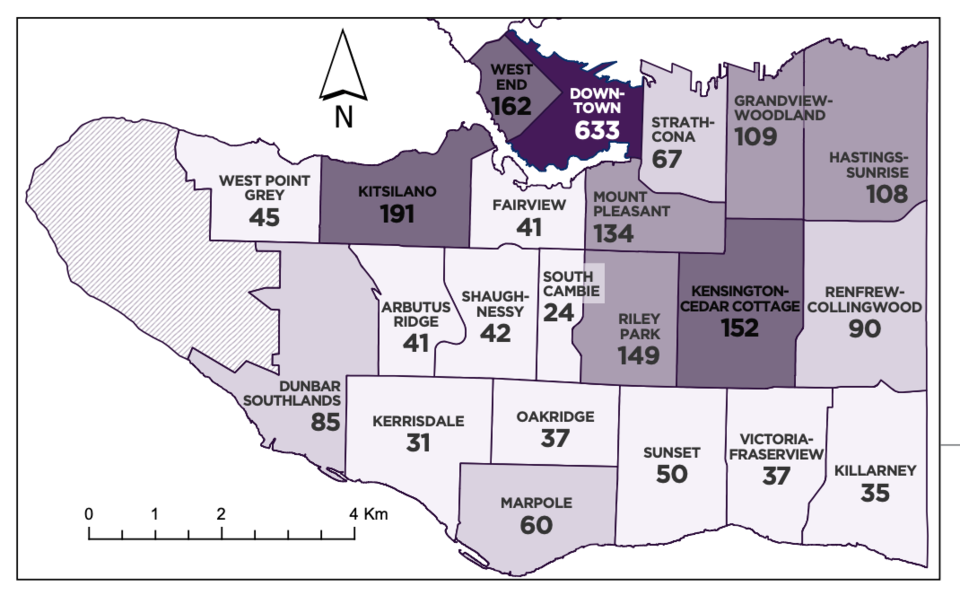

Short-term rentals are on the rise as the world opens up again. The City of Vancouver highlighted Downtown Vancouver, West End, and Kitsilano as the most popular neighbourhoods for short-term rental listings. 74% of the short-term rental operators are owners, versus 26% being renters subletting the residence with permission from the landlord.

The Vancouver Real Estate Podcast echoed the sentiment of condos being a focal point moving forward, and their most recent podcast provided 10 tips for investors in today's market:

- Focus on condos: less of a hassle, it is the segment expected to outperform.

- Create a detailed property search: power of attorney, estate sales, court-ordered sales, etc.

- Understand the resale market: start with the end in mind, who is your target market?

- Run your numbers: ~15%+ renovation costs, time, energy, risk.

- Don’t clean what is already clean: no turnkey properties, limit your burn, think crime scene.

- Look for immutable qualities: good fundamentals, vaulted ceilings, natural light, reputable developer, well-maintained building, and floorplans you can re-configure.

- Make it easy on the seller: super competitive easy offer, only 3-4 clauses, due diligence upfront, make money on the buy, offer to take care of junk removal, etc.

- Learn when to walk away: know when to fold, trust your gut, no unnecessary risk, diagnose what state the building is in, is it insurable, and will lenders lend.

- Winning relationships: don’t do anything on a handshake, form an LLC, get a lawyer, adhere to rules of engagement, and everyone on the team must add value.

- Marketing: always do staging, no virtual staging, take professional photos/video/floorplan, be strategic, understand the building, and know how to handle objections. The end-user always pays more than the investor. Make the prospective purchaser fall in love. Spend the time to make the space look phenomenal. Make your money back tenfold. Be nimble.

Credit: City of Vancouver, Vancouver Is Awesome